An Overview of the Wine Industry

The effects of globalisation can be seen everywhere, virtues and defects of this "brave new world" are disclosed. Trends evinced in the industry such as supply consolidation, improved distribution and logistics systems plus more and better consumer's information, information ubiquity and new requirements in all markets, define the roadmap for the global wine business.

An Overview of the Wine Industry

Ramón A. Rada M.

1. Trends

The effects of globalisation can be seen everywhere, the dislocating effects of the global economy and of capital mobility, as well as access to, and information ubiquity; these forces had change our world for ever. The virtues and defects of this “brave new world” are disclosed. It is no longer possible to avoid its demands and ups and downs. Wine companies have to perform in a steady flow. In this environment there is a significant increase of competition, strategic alliances, the strengthening of local identities and interests, all together with the incorporation of state-of-the-art technology, easy available in every field of industry. This has led to the strong complementation of two universal and omnipresent processes: the one of standardisation and globalisation and the other of sharp differentiation and strengthening of local culture. Simultaneously, all kinds of companies consolidate or merge and reshape the map of domestic and international distribution in most of the major markets, generating new uncertainties. The trends evinced in the wine industry which define the roadmap are:

- Consolidation of supply, distribution and logistics systems

- Better and more information for consumers, information ubiquity

- New and major requirements in all markets

- Rising global wine consumption

1.1 Consolidation of supply, distribution and logistics systems

The shift in power from winemakers, who use to rule supply over the last decades, to consumers, who rule demand and purchasing power, have provoked companies’ reaction in different ways: some have increased their size and the size and diversity of their distribution systems in a search for market shares that will afford a certain degree of stability and reduce the uncertainties of demand. Nonetheless, in a globalised world, uncertainty is a condition of change that cannot be ruled out, whereas the certainties that were taken for granted have disappeared. This situation will necessarily require that we address the relationship between company size and the market in which it operates. This will most probably lead us to witness mergers and alliances between companies devoted to mass markets as they search for volumes that will allow them to fulfill the requirements of such markets. We will also see how companies devoted to intermediate or niche markets will adapt their size accordingly. It is difficult to imagine a company that can cover every single market segment, and therefore each segment will call for a supplier company of a suitable size. This situation will generate a significant change in the form and content of company relationships and their distribution channels, orienting them towards programmes based on the loyalty of the distribution channel. Better care will be taken of the supply chain by means of transferring more costs to the first link of the chain, i.e. the producer. The strength and financial capacity of large-scale companies will lead them to react in two ways: they will become more directly involved in each of the links of the supply chain, thus preventing the loss of power triggered by this situation and will therefore increase their marketing expenses in order to create the highest possible degree of brand fidelity in the end customer in an attempt to generate a barrier that will counterbalance the power of the retail sales systems.

The Internet will contribute to changes in the industry, will render the market more transparent and will make the wine supply available throughout the world, with the consequent strong impact on the logistics and distribution structure. Existing retail traders can become successful electronic traders, initially in the local sphere given the possibility of managing a restricted logistics system that will give them the necessary experience and expertise to reach foreign markets at a later stage. In this way, they will be able to supply their customers with a complete variety of products, together with increasingly detailed information regarding all products. Additionally, those market segments that make use of the Internet more promptly will be the first to generate a relationship with their suppliers, which will permit the intensive use of customer loyalty systems. This will result in the emergence of new distribution channels, based on the opportunities offered by electronic trade, together with home delivery. This medium is especially interesting for the middle and upper market segments. Fragmented and frequent supply provides the opportunity to offer additional product information, and as the costs of home delivery decline, they will gradually become less of an obstacle for those consumers who buy quality wine. The rising power of consumers, which is the reason and justification for these great changes, is both a threat and an opportunity. It is a threat to those traditional suppliers, who are reluctant to change and whose products lack distinction, brand prestige or differentiation. It is an enormous opportunity for those companies wishing to establish a relationship with every link of the supply chain and with its end consumers within the framework of the new paradigmatic concepts generated by the change.

1.2 Better and more information to consumers

Day after day, consumers in all areas are better informed in terms of quantity, quality and accuracy of information. This trend will rise, as the need for product traceability increases, so that it will possible to expect consumers to make better informed decisions within the range that satisfies their requirements. This implies that the market segments will be defined in more accurate detail and that there will be growing fragmentation in the impossible quest for detecting and determining individual needs. The massive individual attention of the end consumer, which is out of the question today as specialists are unable to manage the vast amount of data available, will become more and more feasible thanks to information technologies once such data are subject to further analysis. The key to understanding each segment can be given by a comprehensive understanding of the consumers’ way of thinking, of individual opinions and of those opinions shared with other consumers in the segment, which have become behaviour patterns. In turn, the increasing diversity in the way in which people’s minds work will contribute to segmentation through a process of growing fragmentation. This will make the marketing schemes born in the second half of the 20th century the main tool to be used by the companies of the 21st century. Marketing, often misconstrued and mistaken for its instruments, will be the key to understand consumers and to reorient the adaptability of companies.

1.3 New and major requirements in all markets

In terms of safety for human consumption, the market demands will modify the wine industry completely, with changes in key management areas that will show a tendency toward process automation and process control, in an attempt to reduce human intervention wherever possible. These demands have mainly to do with regulations of consumer safety as established in international treaties and in the domestic regulations of each of the countries that import products for human consumption, as is the case of wine. At the same time, attitudes of the consumers will tend to preserve and increase specific demands, which will determine their consumption decisions; and, finally, there is the externality of increased demands for the incorporation of state of the art technologies for processes and products. These trends will lead to the development of comprehensive and complex monitoring systems for all processes in order to ensure product traceability, and this will in turn generate the obligatory need for the already well-known and widespread process certification, this time also oriented towards product certification. We will not only witness an extension of process certification market, but we will also see the birth of product certification. This certification will be facilitated and accelerated by the new automatic technologies for organic chemical analyses already in use and incorporated into the production lines with the automatic wireless transmission of results to central data administration systems, so that they can be certified by the companies that provide this type of service. In short, technological breakthroughs on all fronts will enable the monitoring, storing and automatic analysis of biological systems that produce organic products for human consumption, leading to robotise food production.

1.4 Rising global wine consumption

Global wine production use to rise steadily since 2000 reaching its peak in 2004, when supply outweighed demand by about 600 million cases. Since then global production has been steadily declining as well as it is doing ending inventories.[1] By 2012, global production dropped to its lowest levels in more than four decades. Since its peak in 2004, production across Europe has fallen by 25% and by about 10% when compared with 2012. And as consumption then inevitably turns to the 2012 vintage, the America’s Morgan Stanley report say they “expect the current production shortfall to culminate in a significant increase in export demand, and higher prices for exports globally”. This could be partly explained by “plummeting production” in Europe due to “ongoing vine pull and poor weather”. At the same time, production in the “new world” countries – Australia, Argentina, Chile, New Zealand, South Africa and the U.S.A. (mainly California) – has been steadily rising. Argentina is currently the world’s fifth largest wine producer by volume – after France, Italy, Spain and the U.S.A. (mainly California) in that order – a position it has held for many years. There are currently more than one million wine producers worldwide, making some 2.8 billion cases each year. The U.S.A. wine making industry is also growing. The number of American wineries has “expanded dramatically” in the last 15 years, according to the report. The National Association of American Wineries reports that in 2007 there were 4,712 wineries in the U.S.A., from which California account with 2.025, Washington with 451 and Oregon with 295, other 47 States account for the remaining 1.941 wineries. But most of them are “boutique” operators rather than major producers, so they’re not driving any real growth in supply. Meanwhile, there is little reason to believe that global wine production will pick up any time soon.

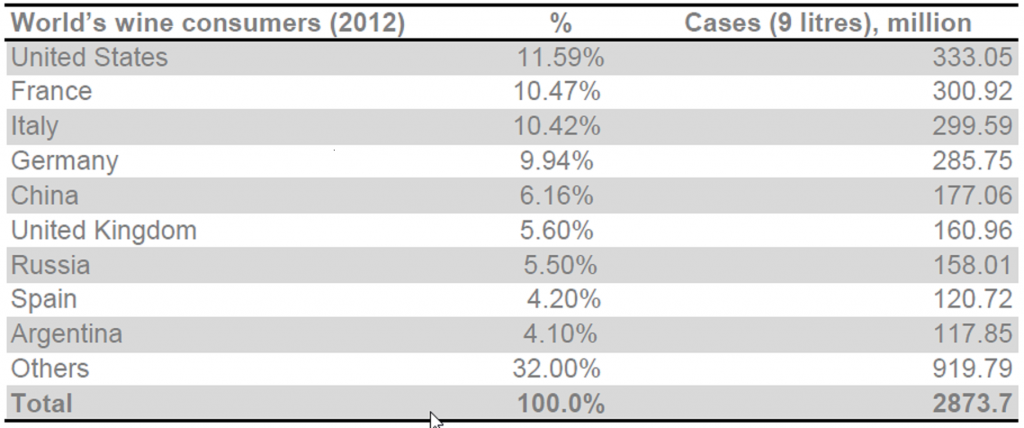

On the other hand, global wine consumption has been rising since 1996 (except a drop in 2008-09 due to the global financial crisis), and presently stands at about 3 billion cases per year. The world is facing a wine shortage, with global consumer demand already significantly outstripping supply, a report has warned. The research by America’s Morgan Stanley financial services firm says demand for wine “exceeded supply by 300 million cases in 2012”. It describes this as “the deepest shortfall in over 40 years of records”.[2] “With tightening conditions in Europe, the major new world exporters stand to benefit most from increasing demand on global export markets.” It also states that the U.S.A. together with China – the world’s fifth-largest market so far – are seen as “the main drivers of consumption globally”. The French use to consume the most wine, followed by Americans, nowadays is the other way around, followed shortly by Italians and Germans and then to a close distance the Chinese. Wine has become particularly popular in China, as the economy booms and the standard of living there rise. The Chinese become aware that drinking wine is healthy as well as stylish to replace other higher alcohol beverages. There is no wonder then to realise that Wine Australia had create a promotional event were they recognise some of Australian wine’s most passionate advocates in China at the inaugural Wine Australia Awards in Shanghai last week of October 2013. Some Australian business intelligence consultants consider China as the Australia own backyard market. Therefore, the Australian awards are aimed to recognise the efforts of importers, distributors, retailers, food and beverage specialists, restaurateurs and educators in China who promote Australian wine. [3]

On the other hand, it’s interesting to remark that only 9 destination markets for wine exporters companies account with 68% of the wine world’s consumption. Therefore, it is not a bold assumption to guess that world wine consumption will rise steadily.

1.5 The bases of change in the industry

The bases of change in the industry are nothing but the changes in current thought amongst consumers and in the philosophy and actions of the industry itself. Globalization has become commonplace, as have the concepts of the convergence of communications and computer systems, together with an apparently new language that distracts us from identifying the essence of change. But, basically, change is as old as human development; only its trends have just become easier to detect. The inability to understand changes, new technologies and their effects on corporate and social organisation contribute to increase uncertainty and fear of the future. Nothing seems stable and nothing can be taken for granted. These are the changes we are undergoing today, and for some they are a source of uncertainty, while others consider them a unique opportunity that must not be missed. Our daily routine has changed enormously in very few years, and the greatest impacts on our lives have been telecommunications, computing and the different forms for the representation of knowledge. We have been moving away from a text culture into a multimedia culture. On the other hand, the vast majority accepts but does not understand the fact that we are living times of change, in which the only certainty is that there is no certainty, and the only stable factor is omnipresent change. This has an effect on absolutely every sphere of life.